Welcome to Fox Narrowboats

We hire canal boats near to Cambridge and Ely from our marina in March, Cambridgeshire in the UK. Experience comfortable cruising on our fleet of luxury narrowboats. Boats can be hired for weekend, midweek or week breaks, as well as 10, 11 or 14 nights. We also have 2 boats for day hire which take up to 10 people. We are nestled in the Fenland Waterways close to the River Ouse and River Nene. Our warm, friendly family business and boating holiday experience stretches back generations.

Explore the Fenland Waterways

‘Discover stunning countryside, English heritage, historic towns & cities’

Adam Henson – BBC’s Countryfile

The Fenland waterways have been described as “a hidden gem” by BBC countryfile’s Adam Henson, who has visited us and been on a Fox narrowboat.

Leave your worries behind and cruise uncrowded waters full of beautiful rivers and open countryside packed with wildlife. There’s lots of tourist attractions and places to visit including the world famous Cambridge University and the grand Ely Cathedral.

Book one of our luxury narrowboats also known a canal boat, barge or longboat.

Day Boat Hire

We offer a narrow boating experience for a day. Our day hire boats are available from 9.30am until 6pm they are popular at weekends so book early. In 2018 we also became known as March Wharf, we are a base for ABC Boat Hire. Gift vouchers can be purchased from our reception.

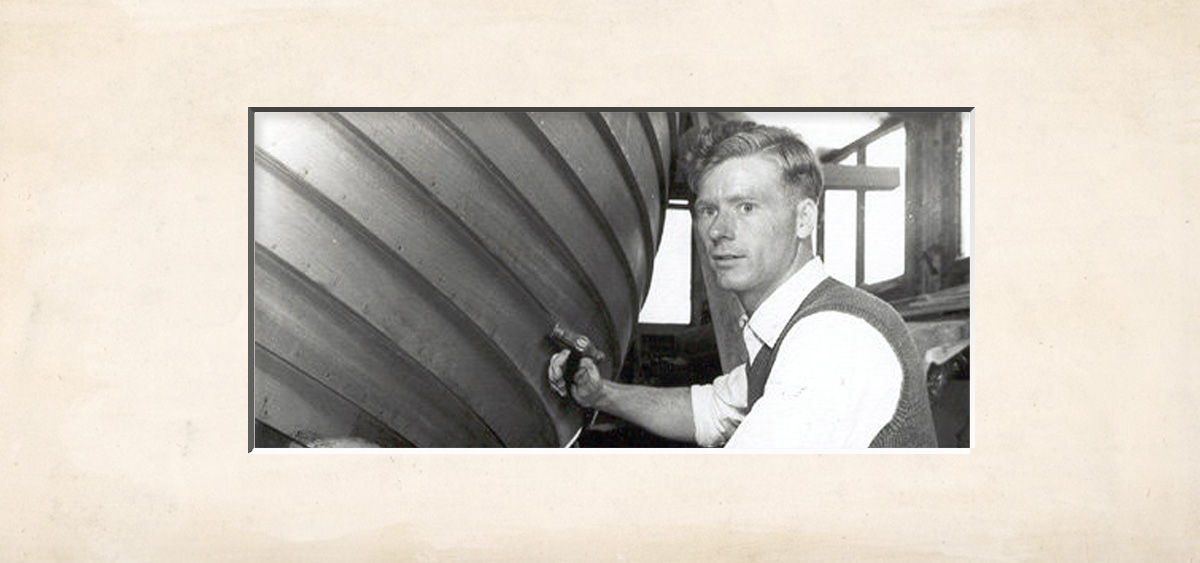

Our Marina

Our popular fully serviced marina has 200 moorings. We have onsite boat building and boat repair facilities.

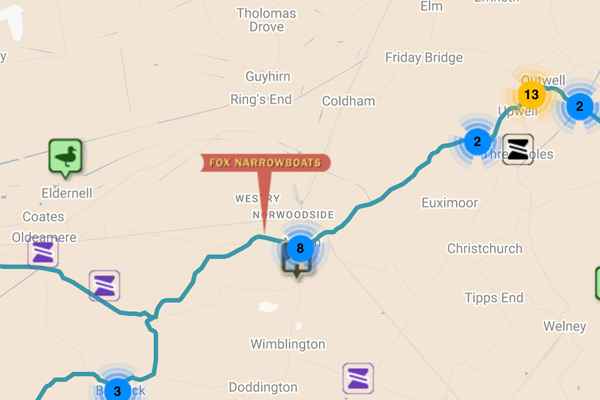

Our New Waterways Map

With over 400 Points Of Interest (POI) our customised google waterways map contains markers that can be filtered includes; moorings, pubs, restaurants, historic sights, churches, places, marina services and more. Text searches allow you to jump straight to the POI. Stretches from March to Cambridge and March to Godmanchester also river Wissey to Brandon. Works on mobile phones.

Our Blog

Visit our fenland waterways blog

Choose from over 250 original hand crafted articles about the Fens waterways, Cambridge, Ely & quaint riverside villages. Find out about amazing things to do and see. Get “in the know” about local fayres & events. Find out about celebrities who have been canal boating and get up to speed on the latest narrowboat TV series you can stream online. Discover narrowboaters knowledge, ownership and guest bloggers views of the future of the local waterways. Completely re-designed, take a peek : Fox blog